Because the liability no longer exists once the loan is paid off, the note payable is removed as an outstanding debt from the balance sheet. Suppose a company needs to borrow $40,000 to purchase standing desks for their staff. The bank approves the loan and issues the company a promissory note with the details of the loan, like interest rates and the payment timeline.

Accounts Payable Vs. Notes Payable: Differences & Examples

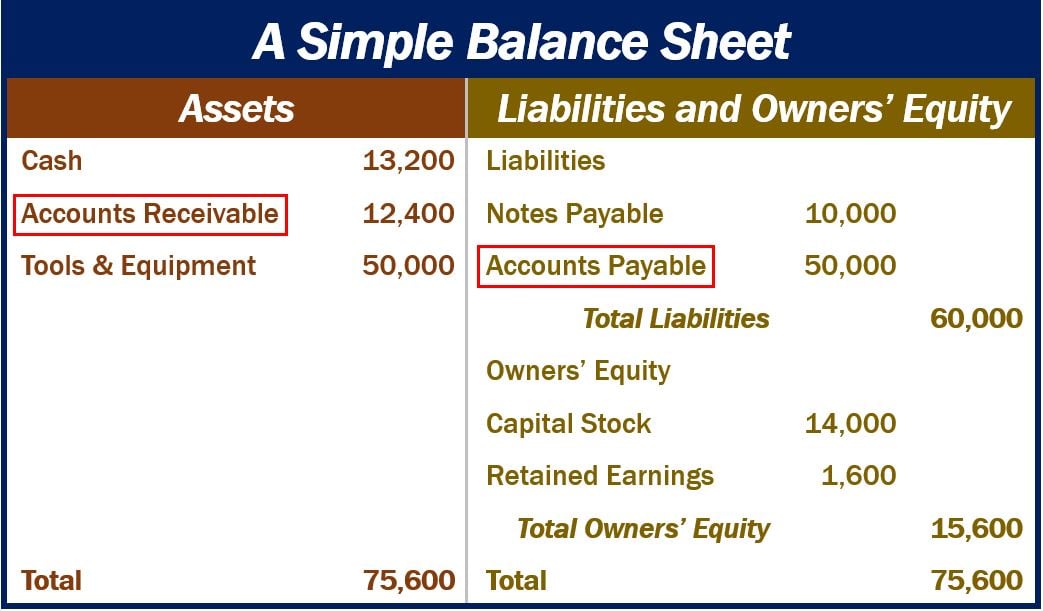

Effective accounts payable management is a crucial part of managing a company’s cash flow. Accounts payable is a liability account recorded on a company’s general ledger that tracks its obligations to pay off a short-term debt to its suppliers and lenders. Again, you use notes payable to record details that specify details of a borrowed amount.

AP & FINANCE

It also shows the amount of interest paid each time and the remaining balance on the loan after each time. Loan calculators available online via the Internet work to give the amount of each payment and the total amount of interest paid over the term of a loan. These require users to share information like the loan amount, interest rate, and payment schedule. Notes payable usually include the borrowed amount, interest rate, schedule for payment, and signatures of the borrower and lender.

Payment processing

- With effortless invoice capturing, seamless approval, and multiple options for one-click payments, you’ll save time and reduce errors.

- A common form of notes payable is a promissory note, which is similar to a loan.

- However, companies and lenders are free to agree to a longer maturity period.

- Depending on the financing, you likely won’t get the same treatment with your notes payable.

Depending on the policy of the vendor or supplier, there may be interest or penalties for late payments which would be clearly outlined in the invoice or purchase agreement. Just as more organizations are moving off paper invoices, there is a move away from paper checks and wire payments to protect against fraud, lower costs, and streamline the payment process. Automated solutions for global payments simplify the process for making payments to potentially thousands of suppliers while eliminating the need for accounts payable to enter data across multiple bank portals. In closing, the accurate recording and management of accounts payable and notes payable are vital components of a successful financial strategy. Ensuring proper handling of these two aspects will contribute to a company’s overall financial health and stability, benefiting both the company and its stakeholders.

Accounts Payable vs. Notes Payable: What Your Business Should Know

The existence of notes payable in a company’s financial records implies a more significant and structured liability than accounts payable. The agreement’s repayment terms, interest rates, and other aspects can impact the company’s cash flow and overall financial health. When dealing with notes payable, managing due dates, interest payments, and principal repayments carefully is crucial to maintain a solid financial position and uphold the company’s reputation with lenders.

This is a legally binding contract to unconditionally repay a specified amount within a defined time frame. It differs from a loan contract in that payments are usually paid monthly rather than in installments. In addition, notes is notes payable the same as accounts payable payable do not contain clauses for recourse actions in the event of default. An example of a note payable would be taking out a bank loan to purchase equipment, with a formal promissory note outlining the repayment terms.

We’ll discuss these business processes in more detail later in this article. Meanwhile, notes payable represents formal debt obligations as it involves borrowing money with specific repayment terms. Understanding the differences and critical roles of accounts payable and notes payable is essential for corporate accountants and financial managers. By properly managing these financial liabilities, businesses can better optimize their cash flows , maintain strong relationships with clients and reduce the risk of financial distress. Notes payable typically extend beyond a year and come with formal loan agreements that include both principal and interest payments. They can be short-term or long-term liabilities, depending on the repayment timeline, and they usually include an interest expense, which accounting departments record alongside the principal.

Accounts Payable refers to the amount a company owes suppliers when goods are purchased or services are availed on credit. It is a current liability account that usually has a credit balance and represents amounts due to suppliers and vendors. It consists of a written promise to repay a loan, usually specifying the principal amount, interest to be paid, and a due date. These notes are typically issued when obtaining a loan from a bank, purchasing a company vehicle, or acquiring a building for the business.