Five months following expiration of $659 million forgivable loan relief program dependent by the CARES Act, the federal government provides paid just as much as 5.2 billion Income Shelter System (PPP) finance. step one

Since talked about in an early aware, 2 the policy factors hidden PPP loans cause them to become inherently insecure to scam. To assists rapid birth out of finance to help you People installment loans Hamilton in the us in need throughout latest financial shutdowns, Congress therefore the U.S. Home business Administration (SBA) imposed a significantly reasonable pub to possess PPP loan qualification, minimally requiring you to candidates thinking-certify the brand new loans needs and therefore the cash is safely allocated to particular costs dropping inside the PPP system. Average and you will antique cover associated government financing underwriting had been set-aside, and you will vetting and you will eligibility checks was basically put off.

Unsurprisingly, accounts out of fraud are now widespread, and extra misconduct might possibly be opened if the deadline to have very first cost (otherwise seeking to financing forgiveness) are attained from the last half regarding the following year. Looking forward to 2021, we could predict the fresh Biden administration to create abreast of current municipal and criminal enforcement of COVID-19-relevant fraud, plus prospective et celle-ci tam and you can authorities started Incorrect States Act legal actions, and you will purchase significant information to help you looking for somebody and you may organizations suspected out-of submission or otherwise engaging in dubious, otherwise downright fraudulent, PPP loan applications. This is what lies to come:

The present day Landscaping

Improved bodies analysis and problems throughout the social within the Q4 2020 foreshadow a possible barrage out of administration methods in the year ahead:

- The fresh new SBA swindle hotline has received over 100,100 problems in 2010 (a great stark evaluate into the 742 problems gotten during the 2019).

- The newest FBIs Web sites Offense Ailment Center provides canned more than 26,100 complaints particularly regarding the COVID-19 and PPP-associated scam.

- Our house Select Subcommittee on Coronavirus Drama enjoys understood a whole lot more than $4 million into the dubious funds.

- The fresh new U.S. Agencies away from Fairness (DOJ) has actually filed criminal charge up against more 80 some body getting thought fraud concerning the programs having CARES Operate rescue, implicating nearly $127 million of the capital offered to people.

- In addition to numerous trade suspensions, the fresh SEC has taken 7 COVID-19-associated swindle actions and has opened over 150 COVID-19-relevant review and you can inquiries.

FBI Manager Indicators Work at Examining Punishment from CARES Act Fund

FBI Director Christopher Wray has just clarified the fresh new FBIs prerogatives in white out-of emerging economic crime trend considering CARES Work stimuli finance: The newest FBIs ripoff reaction people is certainly going just after criminals trying exploit this pandemic and make an instant dollars. step three By way of example, Wray pointed on the DOJs current prosecution away from a former NFL athlete just who allegedly participated in a program to find $twenty-four mil from the CARES Work program. Inside You v. Bellamy, the federal government accuses Joshua J. Bellamy out-of entry deceptive PPP loan requests on the part of their providers, relatives, and associates, following purchasing the loan continues on deluxe points and entertainment. Most of these apps was in fact approved by creditors accountable for control PPP programs, resulting in payouts off $17.cuatro mil. 4

Implications to own Loan providers

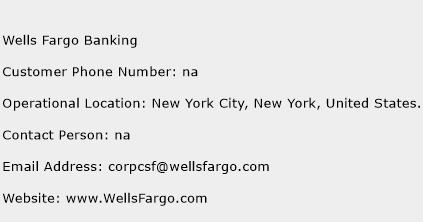

Wray together with recommended finance companies and you may loan providers to assist in so it energy from the engag[ing] toward FBI and reporting proof PPP-associated swindle plans or associated illegal hobby. By doing so, the guy cautioned banking institutions about their role regarding fund illegally received because of the PPP-loan applicants. Except if banks can be to the SBA that they diligently then followed the application legislation inside granting and you may offering people fund, they can be into the link. 5

The new governing bodies suggestions so you can loan providers welcome reliance on the fresh new mind-criteria produced by candidates, for this reason mitigating the risk of municipal otherwise criminal responsibility. You’ll be able, however, that SBA will use their discernment according to the system to help you maybe not pay back exactly what the government deems bad loans, making lenders empty handed.

On the other hand, this new postponement or elimination of lenders old-fashioned qualification and you will homework criteria having verifying PPP debtor qualifications will be reduce steadily the opportunities one if you don’t law-abiding financial companies perform face regulators analysis to have this new fraudulent acts of their borrowers. Still, it’s still you’ll be able to-therefore the Obama-Biden administrations Justice Department centered precedent to own doing so inside the analogous things. six

Hands-on Effect Measures having Activities Connected to PPP Fund

Whether or not DOJ pursues furthermore aggressive theories out of vicarious unlawful liability up against financial institutions processing PPP money remains to be viewed. Yet not, the connection amongst the Federal government one to basic undertook comparable services, plus the Biden administration entering work environment during the , indicates an aspire to pay close attention. Likewise, federal administration agencies have telegraphed you to definitely desire PPP fraud tend to end up being a button appeal in their mind throughout the future months and you will age, which suggests that people and folks involved in the PPP financing process-whether loan providers, ultimate readers, or otherwise-would be to examine its roles, steps, and procedures according to the method before bodies does therefore.

While the made clear over along with past notification, PPP money have been granted with just minimal certification criteria and, in fact, were specifically designed by doing this so you can support quick disbursement off funds in order to People in the us within the serious you need. But not, its intrinsic susceptibly so you’re able to scam intends to getting an extremely politicized, unpredictable, and you can seemed point inside 2021, and you can lenders and you may readers out of loans would like to proactively use enough time open to them now so you can case by themselves with which have complete more than the bare minimum to make certain good conformity that have new PPP program.

Businesses that prepare for this new every-but-specific regulators evaluation of deceptive PPP debtor craft will be ideal-arranged to ascertain by themselves given that witnesses unlike victims otherwise goals away from resulting review, and must demand from inside the-household, and you may probably exterior the recommendations, as needed to take action. Total, loan providers, receiver, and you will one other people mixed up in PPP mortgage approval process have a tendency to have to have shown its certain, good faith, and you may noted operate in order that money not simply might possibly be paid and acquired quickly, as well as meticulously limited by safely safeguarded companies and people. In particular, organizations would be to revisit its handle techniques and you will file the favorable and you will powerful reasons for particularly using her or him during the time (and you may one transform later produced), initiate and you may carry out routine conformity monitors regarding your exact same, identify one red flags indicating fraudulent or other doubtful activity, and you may investigate her or him rightly which have aid away from the recommendations.