You have got heard a while straight back the credit card issuer are getting into the mortgage video game, nowadays the surgery is actually theoretically live.

If your was in fact curious, they scraped and you may clawed its ways toward home loan biz by the obtaining mortgage origination property off Forest, formerly also known as Lending Tree.

So what does Pick Lenders Render?

And they can be used for both a purchase or a great refinance, plus one another speed and you may title and cash-out refinances.

About fixed-rate service, you can get everything from a beneficial ten-12 months repaired to a 30-12 months repaired, which have 15- and you will 20-year fixed choice in-between.

For Palms, the choices try simply for regards to about three, five, and eight years. The favorite 10-12 months Sleeve is actually somewhat missing.

With regard to FHA finance, they supply a good fifteen-seasons and you can 31-12 months mortgage identity, and you will a varying-rate choice. Thus absolutely nothing as well groundbreaking right here, only earliest financial products.

Exactly why are Come across Novel?

Better, it is said having a sleek software process, definition it ought to be an easy task to pertain and also have acknowledged to own your own mortgage.

You can start the process on line from the putting in some elementary pointers, right after which a take a look at home loan banker will call you right back. One to same home loan banker is with you regarding beginning to become.

On top of that, they allows you to safely upload documents and look the latest reputation of your own mortgage 24/eight, through their property loan lending web site.

For go out, they give a good Romantic promptly guarantee you to pledges they are going to get mortgage funded just like the booked otherwise offer you a card as high as $1,100 to have closing costs.

And when you employ him or her getting a consequent pick otherwise refinance, they are going to give you a Greeting back added bonus borrowing as high as $dos,one hundred thousand used towards settlement costs.

New: they are giving a 5% money back incentive and find out cardmembers just who put the assessment deposit to their card, now by way of .

How Would be the Rates?

Simply put, it must be a holder-occupied, single house, plus the borrower should have a beneficial Fico score off 720 otherwise highest.

Additionally, Get a hold of is apparently advertisements cost to possess loan-to-value rates from 70%, that isn’t the product quality 20% down, otherwise 80% LTV.

So you need to enjoys a fairly clean mortgage circumstances to help you snag the claimed rates, and this appear a little higher, specifically which have home loan activities getting paid off.

Currently, they look supply mortgage loans when you look at the 48 says, plus the Area away from Columbia. Ny and you can Utah are absent from the listing.

Its undecided in the event the such states would-be additional afterwards as the surgery allegedly build, in case thus, it will be indexed here.

Possibly it is part of a silky roll-off to guarantee everything you turns out while the planned before getting to your the 50 says. Or even it’s just a simple (otherwise state-of-the-art) certification material.

If however you live in one of many claims stated over, and require much more information off Discover’s mortgage lending system, refer to them as up during the 1-888-866-1212.

It would be fascinating observe how Get a hold of navigates the mortgage market. They certainly have a huge amount of present customers dating so you can faucet on, very they’ll be in a position to expand quickly, and maybe make the mortgage field more competitive.

Even when my suppose is the fact they are going to offer somewhat high-than-sector home loan prices so you’re able to established mastercard customers, and you can financial on the believe and you may reliability to have it the over.

ninety applying for grants Find Home loans Remark

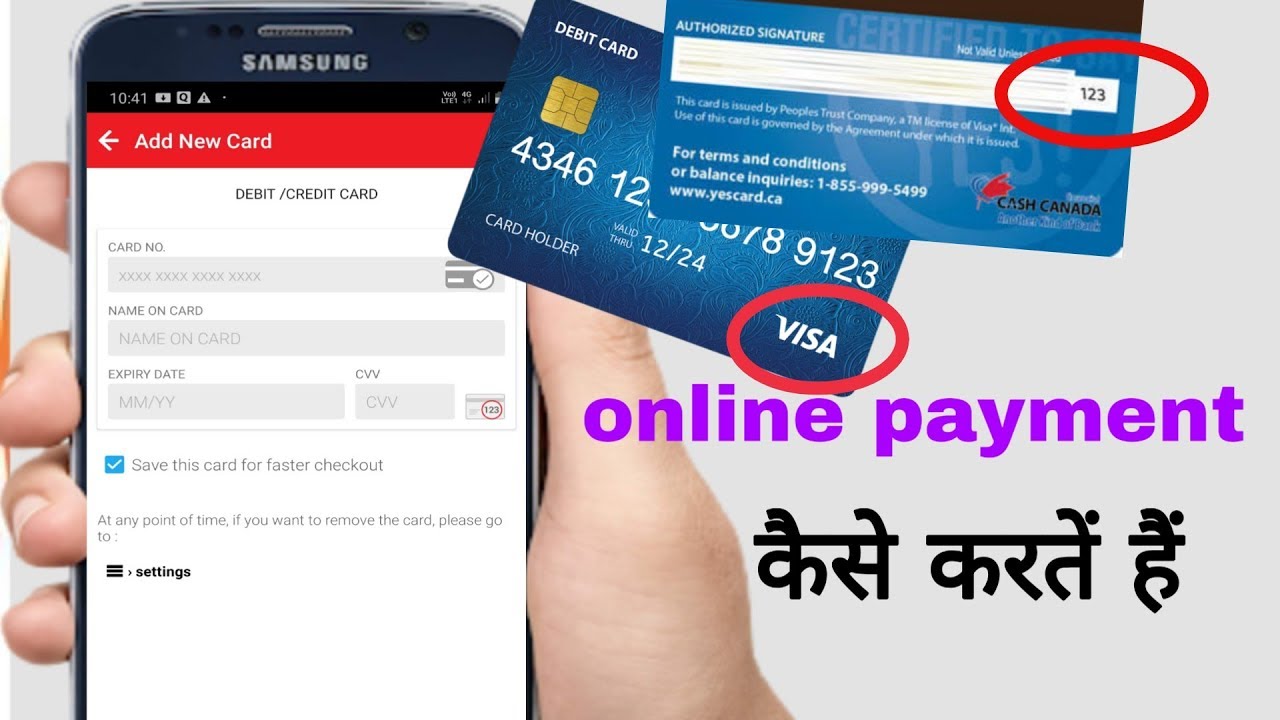

There’s something wrong that have Pick Lenders. We had been looking around so you can refinance, and of the three banking institutions I happened to be talking-to, Come across offered the latest terrible speed (step 3.75% that have one fourth part, while I experienced step 3.75% with .46 write off factors off my personal most recent financial). Thus, enough time story small, i did not move ahead together, but i felt like which in the section ranging from giving my borrowing credit information to help you pre-authorize an assessment and you may prior to actually signing some thing. Brand new pending charge having $six.80 try supposed to be removed out of my credit card if I did not signal the latest documents. But instead it became a good $eight hundred charge getting an assessment that’s never ever taking place. Thank goodness Chase Visa’s argument techniques commonly include me personally from needing to pay. However, I am unable to get Look for in order to opposite the newest charge, or even know one to I’m not refinancing using them. I just discovered other https://paydayloanalabama.com/columbia/ costs having $20 on my mortgage statement to own a benefits report that they questioned! Why in the morning I paying in their mind becoming dumb and you may breaking RESPA?