The modern financial prices throughout the U.S. continue steadily to stay at typically low levels, because the 30-season repaired interest levels hover close step three%. The wonderful pricing continue motivating possible homeowners; although not, qualifying to own financing in the such cost usually demands which have good credit.

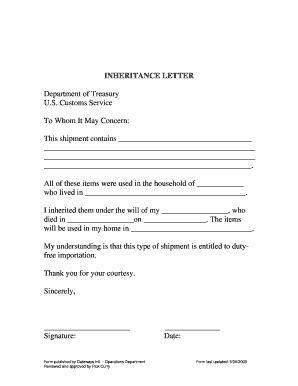

Mortgage Costs Of the Credit history

To own a fixed price, 30-season financing. Based on the myFICO Loan Savings Calculator within the *This is actually the overall desire that would be repaid across the life of the borrowed funds

Users seeking money property buy need certainly to accept the newest critical part one interest levels features to the overall mortgage cost. About 90% regarding individuals like 30-seasons conditions; thus, even a 1 / 2 of a % change in interest rate will get translate so you’re able to several thousand dollars of great interest expenses along the lifetime regarding a loan.

The speed really should not be mistaken for this new yearly payment rate (APR), which includes additional charges. Once the a borrower, the rate you obtain comes from of several products just a few of which it’s possible to handle.

Exactly what Credit score Do you want For the best Home loan Rates?

An informed financial rates basically apply at those with a stronger credit history that demonstrate in charge management of financial obligation. It is best if homebuyers enjoys a credit history of at least 670.

A credit score out of 760 or more is normally felt an effective very good credit rating and must let the borrower accessibility a minimal available cost.

Individuals who initiate our home to get procedure are advised to talk which have a home loan company getting obtaining an excellent pre-recognition. A good preapproval confirms the qualifications getting obtaining a loan, the fresh associated interest, together with limit otherwise limitation that is certainly borrowed.

The minimum credit score needed as well as may differ among the most preferred models or types of financing. These include traditional loans, FHA fund, Virtual assistant financing, USDA funds, and you may jumbo finance.

Traditional Finance

Very antique loans is actually repaired-rates mortgage loans which have set interest levels and require at least 620 credit history. A credit score regarding 740 always qualifies your to discover the best prices.

Understand that individuals searching for a conventional financing might be required to spend private home loan insurance rates (PMI) except if they make an effective 20% down payment.

FHA Funds

New Federal Casing Government (FHA) incentivizes lenders so you can agree mortgages for those with average borrowing from the bank, by the federally insuring the new funds. In the event lenders can get impose their own minimums, individuals have to have a rating with a minimum of five hundred (ideally 580+).

Just remember that , you need a top advance payment count when you yourself have a credit rating lower than 580. And your rate of interest would-be greater!

Virtual assistant Fund

The brand new You.S. Agency regarding Experts Points (VA) including claims loans once the an advantage having current and you will previous army professionals. No matter if no officially given minimal get is available, the https://paydayloancolorado.net/laird/ majority of people that see acceptance has actually at the very least an effective 640 score.

USDA Money

The new U.S. Agency out of Agriculture (USDA) created this choice specifically for borrowers you to live in rural portion. Such Virtual assistant fund, no specialized minimum rating can be acquired; yet not, individuals that have a beneficial 640 get discovered streamlined control and certainly will likely be accepted.

Jumbo Fund

Already, an effective jumbo mortgage loan exceeds $548,250 and usually features stringent standards having certification. The minimum rating one of extremely loan providers try 700, that have an effective 720 generally speaking necessary for acquiring the low rates.

Can i Get A mortgage Having A decreased Credit history?

Just like the the second studies ways, individuals that have lowest credit scores can still qualify for a home loan. Quite often, individuals will pay highest interest levels, have a lot fewer possibilities, and should satisfy some other homeloan payment requirements.

The number one to constitutes low is broadly thought to be are between 580 and 669. Essentially, prospective borrowers which have a get lower than 500 is unrealistic to obtain any willing lenders and must work toward boosting their borrowing.