Brand new understanding on this page are powered by CCH AnswerConnect, Wolters Kluwer’s globe-leading tax search solution. As a result, some of the backlinks included in this article lead to subscriber-just CCH AnswerConnect content. To own accessibility these information, log in otherwise create a courtesy demonstration. For many who fudged the main points on the Paycheck Shelter Program (PPP) financing forgiveness application, you ount.

Consumers need to fulfill criteria to possess PPP mortgage forgiveness

The newest federal government’s Home business Management instituted the brand new PPP financing system to include rescue so you can businesses affected by COVID-19. Brand new program’s purpose was to help enterprises keep its staff members operating in the drama. In the event the taxpayers fulfill the needs, the brand new funds was forgiven. Generally, forgiven funds is actually nonexempt as the launch of loans money. Yet not, a good taxpayer ount off an eligible PPP loan.

With regards to the Internal revenue service, underneath the terms of brand new PPP mortgage system, lenders can be forgive the full quantity of the mortgage if your loan recipient matches three requirements:

- The receiver are entitled to receive the which bank gives personal loan in Riverside Ohio PPP financing.An eligible financing person try a company question, independent company, eligible notice-employed personal, only proprietor, team concern, or a particular form of tax-excused organization which had been (a) operating into or ahead of , and you may (b) got team otherwise independent designers who have been paid for its qualities. Self-functioning someone, sole proprietors, and you can separate designers are also qualified readers.

- The loan continues were used to blow eligible expenditures. Eligible expenditures were things such as payroll will set you back, rent, attention into business’ financial, and resources.

- The borrowed funds recipient removed loan forgiveness. The borrowed funds forgiveness software called for financing individual so you’re able to vouch for qualifications, make sure specific monetary suggestions, and you will see other court qualifications.

In the event that an effective taxpayer match this new criteria above, brand new taxpayer ount of PPP loan off earnings. Whether your criteria are not found, the brand new taxpayer have to are due to the fact taxable money the latest portion of forgiven PPP financing continues which do not meet with the criteria.

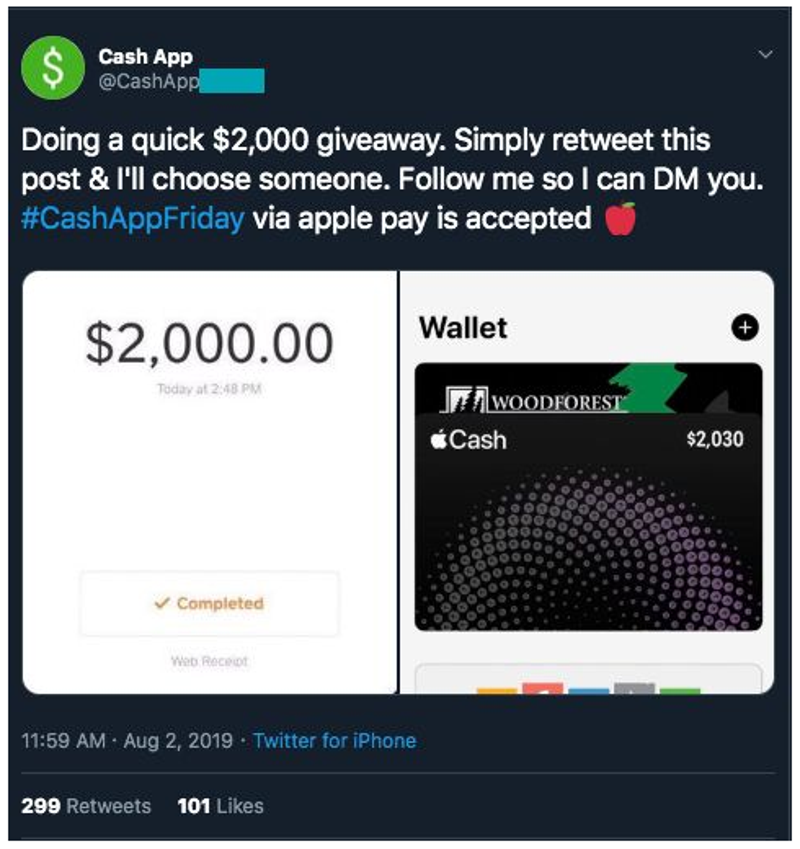

Misrepresentations located of the Irs

The fresh Irs has stated that numerous PPP loan recipients which acquired loan forgiveness was in fact licensed and you will used the financing continues securely so you’re able to shell out eligible expenses. However, the Internal revenue service enjoys discovered that specific receiver exactly who obtained financing forgiveness don’t meet no less than one qualifications criteria. With respect to the Irs, this type of readers received forgiveness of their PPP mortgage using misrepresentation or omission and you will possibly don’t be considered for a good PPP loan or misused the borrowed funds proceeds.

For example, think that Shady are an eligible small company one acquired a PPP loan, however, did not utilize the mortgage continues to possess qualified costs. The business removed forgiveness of its PPP loan inside the 2020 as if it had been entitled to financing forgiveness. In loan forgiveness software, Shady did not is all the associated products who imply that it was not qualified to receive a qualifying forgiveness of the PPP financing. Based on the omissions and you will misrepresentations toward app, the lending company acknowledged the applying, and you will Questionable obtained forgiveness of its PPP loan. Because the PPP loan forgiveness was according to omissions and misrepresentations, the mortgage does not slip in extent of loans one would-be forgiven. Dubious, for this reason, may well not ban the loan forgiveness from gross income.

Taxpayers urged so you’re able to comply. normally

The Internal revenue service try urging taxpayers which wrongly gotten forgiveness of their PPP financing when deciding to take tips in the future into conformity. They may be able do that, eg, by the filing revised yields that are included with forgiven mortgage just do it amounts in money.

At the same time, on terms and conditions out-of Irs Commissioner Chuck Rettig, We need to make certain people who are mistreating such as for instance software take place responsible, and we will be thinking every offered cures and you can punishment streams to address the newest abuses.